How much can a U.S. president committed to greater equality hope to accomplish when lawmakers devoted to helping the rich hold the upper hand?

Advocacy for equality must take a backseat, Obama administration insiders insist, when fanatical friends of the fortunate in Congress recklessly endanger our nation.

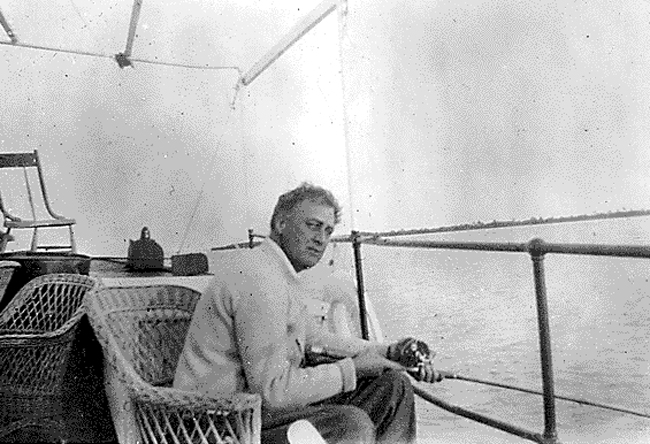

But in 1943, a U.S. president confronted a debt ceiling crisis just like Obama’s — and came up with a different answer. Facing rabid lawmakers every bit as opposed to taxing the rich as ours today, Franklin D. Roosevelt didn’t let up on the struggle for a more equal America. He doubled down.

Roosevelt’s debt ceiling battle actually began right after Pearl Harbor. The nation needed a revenue boost to wage and win the war.

FDR and his New Dealers wanted to finance the war equitably, with stiff tax rates on high incomes. How stiff? FDR proposed a 100 percent top tax rate. At a time of “grave national danger,” Roosevelt told Congress in April 1942, “no American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year.” That would be about $350,000 in today’s dollars.

The year before, steel exec Eugene Grace had grabbed $522,537, over $8 million today, in 1941 salary.

But conservative lawmakers would quickly reject FDR’s plan. Four months later, Roosevelt tried again. He repeated his $25,000 “supertax” income cap call in his Labor Day message.

The Live Commentary