I worked with Founders, CEOs and funds to save 7 companies from bankruptcy. In B2B, Consumer, and Infrastructure, from Series A to post-IPO. Saving tens of thousands of jobs, generating $2B+ in cash, and rising again, stronger than ever.

As times will become very tough, if not life-threatening for most startups, here is a selection of very practical and quick restructuring solutions and tools we have used.

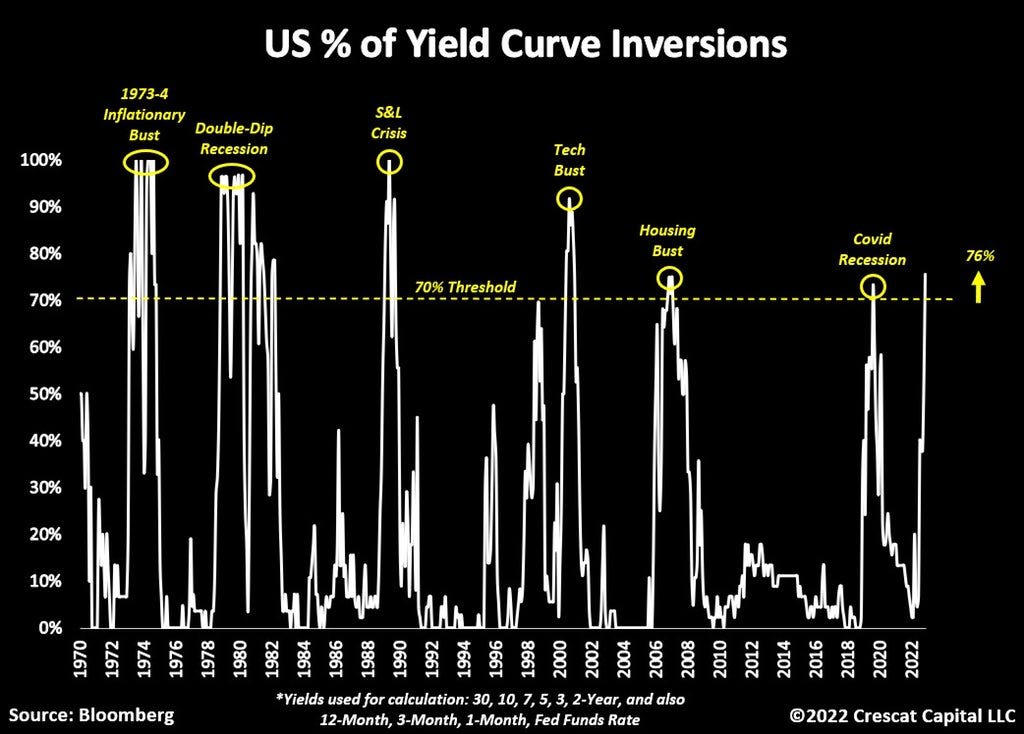

We are undeniably well engaged into a recession that will profoundly affect startups lifeblood: Revenue and Fundraising. Yes, it does feel very 2001.

There is no objective reason in sight why this downturn wouldn’t last at least as long as the shortest of the 6 previous ones: 2 years.

A big ice bucket which thermic shock will be amplified on an ecosystem that comes out of the most heated and excessive time in its history: hundreds of startups burning billions of dollars on broken economic models and bloated organizations, often in very crowded and each time narrower serviceable markets.

On the other hand, VCs still need at least a couple of quarters to fully evaluate how deep are their losses. Most still have 4-5 years to deploy their recently raised funds: really no need to rush writing new checks. Late stage valuations have plummeted, and structured terms are back.

There are only two reasons why startups die: Founders give up ; Run out of cash.

Any Founder should rush to secure at least 2 years of runway

and aim at becoming Net Cash Neutral meanwhile.

To achieve this outcome, many will need to do a profound restructuring well beyond layoffs, to fix their economic models, cleanse unhealthy customer bases and slash dangerously high operating costs. Hopefully this newsletter will help them get off to a strong start.

Your mission alone won’t keep your business alive. Only your bank account can.

The perfect time to act is now.

Let’s quickly evacuate the two most obvious cases, no matter how many millions you still have in bank.

Case 1: Software startups who have not yet proven Product x Market Fit

Immediately scale back to a nimble and scrappy A-team that can fit in a We Work meeting room around the Founders. Scale down to a monthly burn in the low hundreds of thousands of dollars, at most, until you firmly secure PMF.

💡 A dozen of your friends using your product doesn’t prove PMF anymore.

Case 2: Series B+ with indisputable PMF, but no proven economic model

No matter how massive is your user base and MoM growth, you need to acknowledge your company is on slow-death mode and interiorize that survival is a pre-condition to growth. In his own way, Elon is currently applying the playbook to Twitter:

-

Scale back drastically, ideally the closest to your Series A size and cost base

-

Protect your core: engineering and science

-

Founders must go back in the trenches and own back the direct leadership on: product development, engineering, monetization and hiring

-

Stop spending on acquisition. Rather focus on user retention and engagement

-

Multiply monetization iterations to find how to make your cash register ring

-

Diversify your insight / input providers as you brainstorm on how to make money

-

Make sure all your teammates are on the same new page. Get rid of misbelievers and road-blockers in no time

💡 Have you even straightly asked your users: what would you be ready to pay for?

There is no such thing as ‘fixed’ costs. Full stop.

Proof is, if your company liquidates, all costs go down to zero. So have no tabus, consider everything being up for cuts or renegotiation.

The most common mistake is to rush to the conclusion: payroll being our biggest operating cost, let’s layoff and we’ll be fine. Layoffs are most probably unavoidable, and we’ll get to them in the next chapter.

You should start with the faster and easier actions:

-

Lock your bank account: suspend all payment authorization rights but yours and your CFO’s

-

Suspend issuance of hiring offers

-

We are close to year-end: don’t promise any cash bonus yet

-

Freeze all payments that would not result in an outage: rent, non technical vendors, professional services, etc.

You’ll get back to them in a more discriminate way in a couple of weeks, once you have a clearer overall plan

-

Dedicate a street smart colleague to collect outstanding receivables. Consider paying her/him a success fee

-

Take a few hours to stitch the smaller wounds that have a big role in setting the new tone. Such as: stop ordering snacks, swags and perks, return those new MacBooks and iPhones, stop all subscriptions non critical to customer service, cancel furniture orders, etc.

Don’t plan nor debate too much. Just do it.

💡 If you have A-grade enterprise customers (or resellers), selling your invoices to Factoring is non-dilutive, cheaper and faster cash than raising funds. Doing it in a D2C allowed us to need only 3 raises before Exit, with Founders still owning 50% of the company.

Then you need to spend more time on the deeper and more complex hemorrhages: cash destroying customers, products, territories, offices, etc.

Pricing is the most powerful lever to improve your cash position in no time.

In my experience with startups, it is very over-looked, and I see teams spending a lot more time discussing rebates & discounts than prices. Too many startups under-price their value in the first place: lack of experience and knowledge, fear, priority to growth, etc.

Yet, the pricing math is extremely powerful: suppose your current price is $100, and your EBITDA margin is 5% (that is of revenue). Increasing your price by a mere 5% = 5$, results in … doubling your EBITDA.

Of course, price sensitivity can come into play, and you may lose some customers or experience a hike in plan downgrades. But more often than not, when startups I accompanied raised their real prices smartly (start by reducing discounts), benefits far outweigh the losses.

💡 Iterate to negotiate with your customers. Not amongst yourselves in closed rooms.

Sure, times are tough for everyone. But your responsibility is to save your company. Ultimately your options are: they pay, or they downgrade and pay, or you suspend / stop service.

Some of them are big companies defaulting on big amounts and not returning your calls? Send success-fee based collection firms after them.

The defaulting customer is also your vendor? Stop paying in return. Consider bartering.

You may not have enough time ahead to wait for the ‘Free’ to produce the ‘mium’.

-

Calculate their TCO (Total Cost of Ownership) and hang it on the wall: for them it’s free, for us they cost $$ per day

-

Estimate how many months do Free customers take to pay back for their total cash costs

-

Pay back in less than 12 – 18 months? Not bad. Still try to reduce the cost of serving them: lower/no customer support, deactivate features that grow AWS bills, automate product set-up, etc

-

Longer payback time? Shift some to ‘paid’ (even to a symbolic fee), get rid of some. If you can’t honestly see through the economic advantage of the free plan altogether depending on how big is their cash drain.

‘Free’ is and will remain seminal to SaaS, Gaming, etc. You need to be well aware that more than ever, nothing will be given ‘free’ to you. And more likely than not, massive growth of non-paid customers won’t impress VCs as much. So make sure you calibrate ‘free’ as tight as necessary for your 2 years runway. You will always be able to reopen the tap once your runway is under control (or your competitors go out of business, allowing to charge a premium on other plans).

For the 20% of them draining 80% of the cash losses:

-

Think in terms of cash-payback time, taking full CAC into account (in SaaS, MRR is of no use for these circumstances)

-

Reprice as many as you can: price increase, reduce/stop existing discounts, change service level. You will be surprised that sometimes you may even grow your business with them

-

Some may have good value to provide in return: testimonials, referrals, social media posts, customer reference calls, etc

-

In entreprise, be careful with, but not shy of, those customer who strongly legitimize your product

-

Respectfully suspend those who are not worth it anymore

💡 For the 20% of your customers generating 200% of your cash,