- Carbon pricing gives entities a choice between reducing emissions or paying for them, primarily through carbon taxes or emissions trading systems (ETS).

- Europe houses 24 of the 70 active global carbon pricing initiatives, with the EU ETS being the world’s largest carbon market.

- Effective carbon pricing has aided in emission reductions, as seen in the EU and California, but proper design and execution are critical for success.

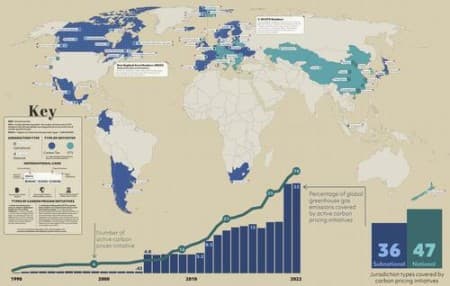

As Visual Capitalist’s Freny Fernandes details below, over the past two decades, governments around the world have responded to climate change through various initiatives and policies, with carbon pricing at the forefront.

A recent example is the Canadian province of Ontario’s Emissions Performance Standards program, first launched in 2022. The program sets annual carbon emissions limits for industrial facilities, with a fee on excess carbon emitted.

This graphic by Jonathan Letourneau maps 70 active carbon pricing initiatives around the world and highlights their global impact as seen in the 2022 World Bank report.

But first, let’s look at the different types of carbon pricing:

Carbon Tax vs. ETS

Broadly speaking, carbon pricing gives emission generating organizations a choice between reducing their carbon emissions and paying for them.

The two typical initiatives used to offer this choice are carbon taxes and emissions trading market(ETS):

- Carbon tax: This tax or levy is directly applied to the production of carbon emissions or fuels that release greenhouse gases. This makes products or services that release substantial carbon more expensive than greener alternatives (or reducing emissions).

- Emissions Trading (ETS): Also called the cap-and-trade, ETS puts a cap on the total level of greenhouse gases a licensed industry can emit. Companies with low emissions can sell their unused emission allowance with larger emitters that have exceeded the cap.

The World’s Carbon Pricing Initiatives

As of the end of 2022, Europe was home to 24 of the 70 active carbon pricing initiatives in the world.

| Location | Carbon Pricing Type | CO2e Price Per Tonne (USD) | Emissions Covered (Tonnes) |

| ???????? Argentina | Carbon tax | $4.99 | 79.46 |

| ???????? Austria | ETS | N/A | 34.41 |

| ???????? Canada | ETS | $39.96 | 53.35 |

| ???????? Canada | Carbon tax | $39.96 | 167.67 |

| ???????? Canada – Alberta | ETS | $39.96 | 140.36 |

| ???????? Canada – British Columbia | ETS | $19.98 | N/A |

| ???????? Canada – British Columbia | Carbon tax | $39.96 | 46.41 |

| ???????? Canada – New Brunswick | ETS | $39.96 | 7.05 |

| ???????? Canada – New Brunswick | Carbon tax | $39.96 | 5.50 |

| ???????? Canada – Newfoundland and Labrador | ETS | $39.96 | 4.59 |

| ???????? Canada – Newfoundland and Labrador | Carbon tax | $39.96 | 5.01 |

| ???????? Canada – Northwest Territories | Carbon tax | $31.97 | 1.33 |

| ???????? Canada – Nova Scotia | ETS | $23.10 | 14.02 |

| ???????? Canada – Ontario | ETS | $31.97 | 41.12 |

| ???????? Canada – Prince Edward Island | Carbon tax | $23.98 | 0.97 |

| ???????? Canada – Quebec | ETS | $30.83 | 60.92 |

| ???????? Canada – Saskatchewan | ETS | $39.96 | 10.23 |

| ???????? Chile | Carbon tax | $5.00 | 36.93 |

| ???????? China | ETS | $9.20 | 4,500.00 |

| ???????? China – Beijing | ETS | $6.53 | 31.89 |

| ???????? China – Chongqing | ETS | $5.66 | 67.14 |

| ???????? China – Fujian | ETS | $1.83 | 125.13 |

| ???????? China – Guangdong (except Shenzhen) | ETS | $12.51 | 259.23 |

| ???????? China – Hubei | ETS | $7.24 | 63.80 |

| ???????? China – Shanghai | ETS | $9.28 | 78.48 |

| ???????? China – Shenzhen | ETS | $0.64 | 13.17 |

| ???????? China – Tianjin | ETS | $4.40 | 53.08 |

| ???????? Colombia | Carbon tax | $5.01 | 44.68 |

| ???????? Denmark | Carbon tax | $26.62 | 17.21 |

| ???????? Estonia | Carbon tax | $2.21 | 1.41 |

| ???????? EU – Norway, Iceland, Liechtenstein | ETS | $86.53 | 1,626.60 |

| ???????? Finland | Carbon tax | $85.10 | 26.93 |

| ???????? France | Carbon tax | $49.29 | 157.78 |

| ???????? Germany | ETS | $33.16 | 349.44 |

| ???????? Iceland | Carbon tax | $34.25 | 2.72 |

| ???????? Ireland | Carbon tax | $45.31 | 27.05 |

| ???????? Japan | Carbon tax | $2.36 | 952.66 |

| ???????? Japan – Saitama | ETS | $3.84 | 8.16 |

| ???????? Japan – Tokyo | ETS | $4.42 | 13.26 |

| ???????? Kazakhstan | ETS | $1.08 | 169.18 |

| ???????? Korea, Republic of | ETS | $18.75 | 554.44 |

| ???????? Latvia | Carbon tax | $16.58 | 0.38 |

| ???????? Liechtenstein | Carbon tax | $129.86 | 0.15 |

| ???????? Luxembourg | Carbon tax | $43.35 | 6.80 |

| ???????? Mexico | Carbon tax | $3.72 | 352.61 |

| ???????? Mexico | ETS | $3.72 | 320.55 |

| ???????? Mexico – Baja California | Carbon tax | N/A | N/A |

| ???????? Mexico – Tamaulipas | Carbon tax | N/A | N/A |

| ???????? Mexico – Zacatecas | Carbon tax | N/A | N/A |

| ???????? Montenegro | ETS | N/A | N/A |

| ???????? Netherlands | Carbon tax | $46.14 | 25.96 |

| ???????? New Zealand | ETS | $52.62 | 41.61 |

| ???????? Norway | Carbon tax | $87.61 | 44.73 |

| ???????? Poland | Carbon tax | N/A | 15.94 |

| ???????? Portugal | Carbon tax | $26.44 | 25.04 |

| ???????? S |